PON industry trends

PON network by OLT (generally in the room), ODN, ONU (generally in the user, or close to the user’s corridor location) three parts, among them, the part between OLT to ONU of the line and equipment are passive, so called passive optical network (PON), also called optical distribution network (ODN), with the popularity of optical fiber communication, more operators use PON network to support unified optical fiber access network, provide mature FTTH solution, to provide users with data, video, voice and other services.

According to the latest forecast for a well-known organization, the global PON market will grow at a compound annual growth rate (CAGR) of 12.3% between 2020 and 2027, and is expected to reach $16.3 billion by 2027, up from $8.2 billion in 2020. ONT / ONU port consumption has been strong in recent years, with FTTH and PON applications in non-residential areas are driving this growth. With the adoption of 10G and 25G solutions, PON is now available to support mobile xHaul and commercial services. By the end of 2022, next-generation PON port device revenue is expected to account for 50% of total PON port device revenue and 87% by 2027. This includes Combo PON port solutions that support 10G or 25G PON as well as 50G PON. At the same time, PON OLT port shipments are gradually increasing, reflecting the trend to deploy, expand and upgrade networks. With the maturity and popularization of GPON technology, and the application of 10G EPON, OLT port consumption is also a part that cannot be ignored.

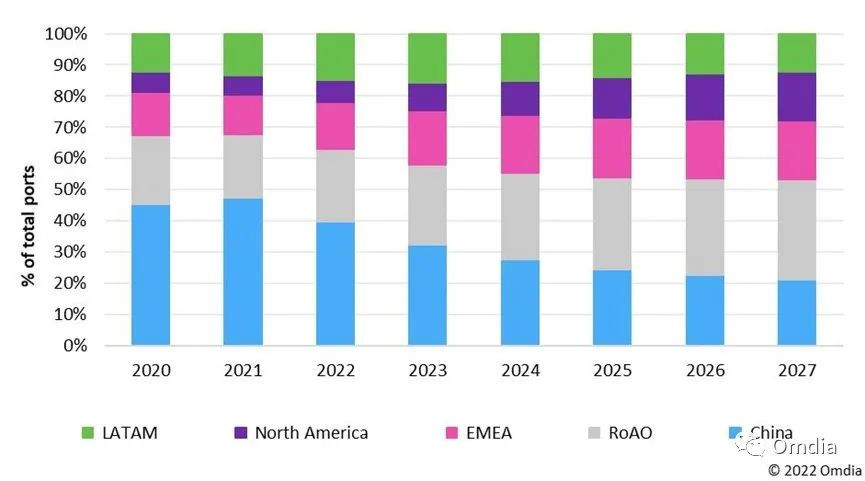

China has long been the largest consumer of PON access devices, according to the report. This is due to China’s early adoption of FTTH across the country, and has a large population size and application. In 2020, China accounted for 45% of the total PON device port consumption. China will continue to consume PON devices, but will no longer dominate during the forecast period. By 2027, operators in Europe, the Middle East and Africa (EMEA) and the rest of Asia & Oceania will consume 51% of the total PON ports, up from 36% in 2020. The rest of Asia & Oceania will grow significantly with a CAGR of 21.8% between 2020-2027. Many operators in this large area are upgrading to 10G PON, while others are building FTTH networks with GPON, such as in India.

Figure 1: PON equipment revenue forecast by region / country (2020-2027)

In North America, various network operators are building and upgrading PON networks, some of which are more vocal than others. During the forecast period, the region will grow with a 24.0% CAGR. Public funding will support network expansion and the entry of new operators to the market.

Several Latin American & Caribbean countries are investing in PON networks, particularly in the Mexican and Brazilian markets. The region is expected to grow with a 7.1% CAGR. Some Cable operators in this region are abandoning DOCSIS 4.0 in favor of PON-centric networks.